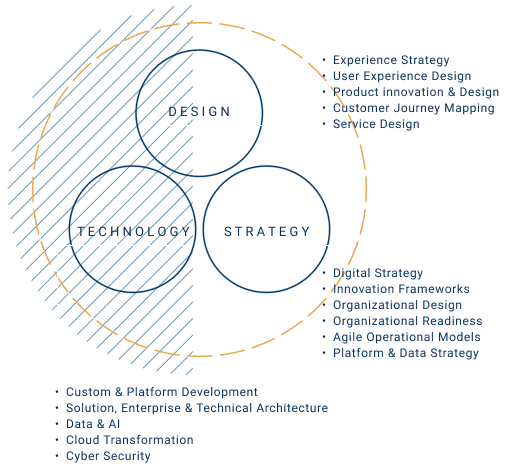

One Partner,

All the Capabilities

Your teams do not need a new vendor for every initiative. They need one partner who can move from strategy to design to delivery without dropping the thread.

One compact team that can support deal thesis, value creation plans, and execution.

One team across fund and portfolio

Our teams work side‑by‑side with your deal partners and portfolio leaders. We manage the digital workstreams, vendors, and technical detail so you can focus on investment decisions, board conversations, and performance.

By extending your digital capacity on strategy and delivery, your CFO and operators get clarity on where to invest, what to pause, and what will really move the P&L.